The 7-Minute Rule for Frost Pllc

The 7-Minute Rule for Frost Pllc

Blog Article

Indicators on Frost Pllc You Should Know

Table of ContentsAn Unbiased View of Frost PllcAn Unbiased View of Frost PllcFascination About Frost PllcThe 10-Minute Rule for Frost PllcA Biased View of Frost Pllc

Certified public accountants are among the most trusted careers, and completely factor. Not only do CPAs bring an unequaled level of understanding, experience and education to the procedure of tax planning and managing your cash, they are particularly educated to be independent and unbiased in their work. A CPA will aid you protect your rate of interests, pay attention to and address your issues and, just as crucial, provide you peace of mind.Hiring a neighborhood Certified public accountant firm can positively influence your company's financial health and wellness and success. A local Certified public accountant firm can help reduce your organization's tax obligation concern while guaranteeing conformity with all relevant tax regulations.

This growth shows our dedication to making a favorable influence in the lives of our clients. Our dedication to excellence has been acknowledged with numerous honors, consisting of being called one of the 3 Best Bookkeeping Companies in Salt Lake City, UT, and Finest in Northern Utah 2024. When you collaborate with CMP, you come to be part of our family members.

Frost Pllc - Questions

Jenifer Ogzewalla I've functioned with CMP for a number of years now, and I have actually actually appreciated their competence and effectiveness. When bookkeeping, they work around my timetable, and do all they can to maintain continuity of workers on our audit.

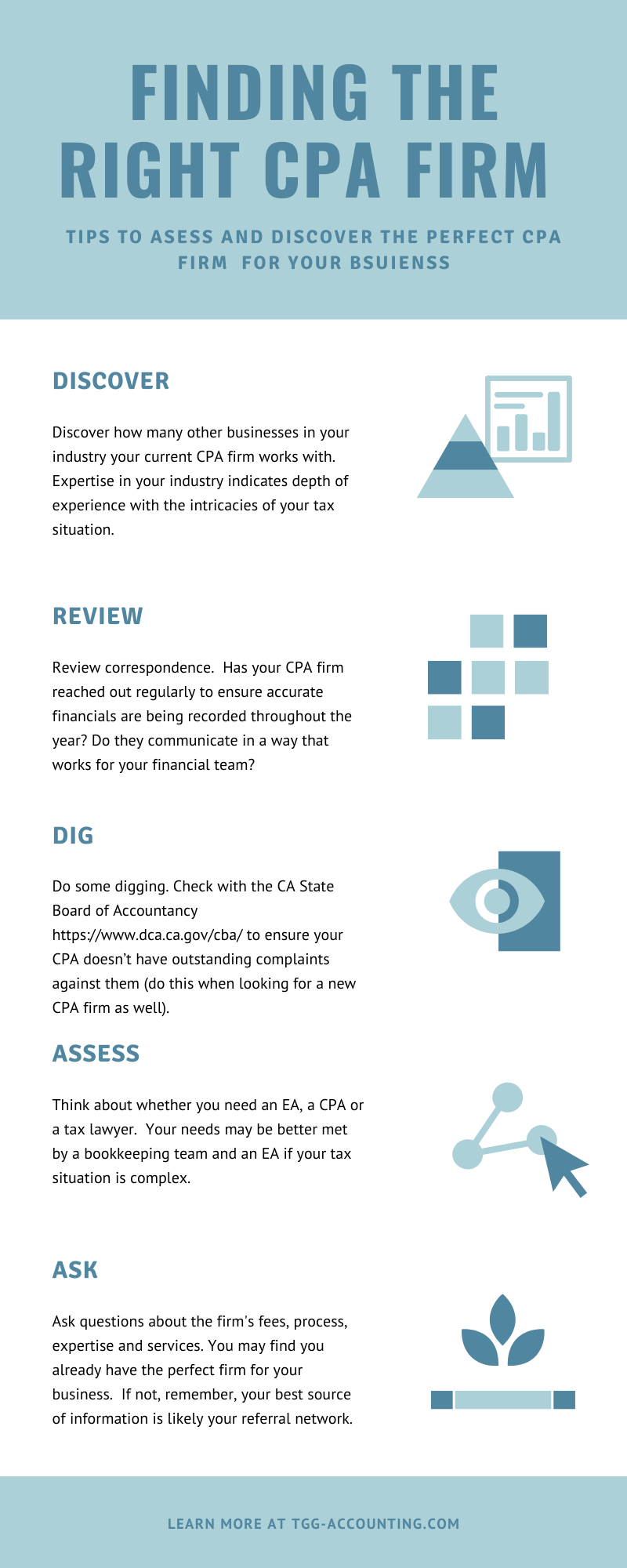

Here are some vital questions to guide your decision: Check if the CPA holds an active certificate. This assures that they have actually passed the needed examinations and fulfill high ethical and specialist criteria, and it shows that they have the qualifications to manage your monetary issues responsibly. Validate if the CPA uses solutions that align with your organization requirements.

Small businesses have one-of-a-kind financial needs, and a CPA with relevant experience can offer even more customized suggestions. Ask about their experience in your market or with businesses of your dimension to guarantee they understand your specific obstacles.

Clear up just how and when you can reach them, and if they use routine updates or examinations. An easily accessible and responsive CPA will certainly be invaluable for timely decision-making and assistance. Employing a neighborhood certified public accountant company is more than simply contracting out financial tasksit's a smart financial investment in your business's future. At CMP, with offices in Salt Lake City, Logan, and St.

The Frost Pllc Diaries

An accountant that has actually passed the CPA examination can represent you before the IRS. CPAs are certified, accounting specialists. CPAs may work for themselves or as part of a firm, relying on the setup. The cost of tax prep work might be reduced for independent professionals, however their competence and capacity might be less.

documents to a company that focuses on this area, you not only totally free yourself from this taxing task, yet you likewise cost-free yourself from the risk of making mistakes that could cost you monetarily. You might not be benefiting from all the tax savings and tax obligation reductions offered to you. One of the most crucial inquiry to ask is:'When you conserve, are you placing it where it can expand? '. Lots of organizations have executed cost-cutting steps to reduce their general expenditure, but they have not put the cash where it can aid business grow. With the aid of a CPA company, you can make one of the most enlightened choices and profit-making strategies, taking into consideration the most existing, current tax guidelines. Government firms in all degrees require paperwork and conformity.

The Facts About Frost Pllc Uncovered

Handling this duty can be a frustrating task, and doing glitch can cost you both monetarily and reputationally (Frost PLLC). Full-service CPA firms know with filing needs to guarantee your organization complies with government and state legislations, along with those next page of banks, financiers, and others. You may require to report additional income, which might need you to file an income tax return for the very first time

team you can rely on. Contact us for additional information regarding our solutions. Do you comprehend the accounting cycle and the actions associated with making sure correct monetary oversight of your service's monetary wellness? What is your organization 's lawful framework? Sole proprietorships, C-corps, S corporations and collaborations are taxed differently. The more complex your earnings resources, venues(interstate or worldwide versus regional )and sector, the extra you'll need a CPA. Certified public accountants have more education and learning and undergo a rigorous qualification procedure, so they cost more than a tax preparer or accountant. On average, small companies pay in between$1,000 and $1,500 to work with a CERTIFIED PUBLIC ACCOUNTANT. When margins are limited, this expense may beout of reach. The months before tax obligation day, April 15, are the busiest season for Certified public accountants, complied with by the months prior to completion of the year. You may have to wait to get your concerns addressed, and your tax obligation return might take longer to complete. There is a restricted number of CPAs to walk around, so you may have a hard time locating one specifically if you've waited until the eleventh hour.

CPAs are the" large guns "of the accountancy sector and usually do not handle day-to-day accountancy jobs. Commonly, these other kinds of accountants have specializeds across areas where having a Certified public accountant license isn't required, such as monitoring bookkeeping, nonprofit accounting, cost bookkeeping, government accountancy, or audit. As an outcome, using an accountancy solutions firm is commonly a far much better worth than employing a CERTIFIED PUBLIC ACCOUNTANT

firm to company your sustain financial management efforts.

CPAs also have proficiency in creating and developing business policies and treatments and assessment of the functional demands of staffing models. A well-connected CPA can leverage their network to help the company in various critical and consulting functions, effectively connecting the company to the ideal candidate to satisfy their needs. Next time you're looking to fill up a board seat, think about getting to out to a Certified public accountant that can bring worth to your organization in all the means noted above.

Report this page